Cryptocurrency, a digital or virtual form of currency that uses cryptography for security, has taken the world by storm. It’s a decentralized form of currency, meaning it operates independently of a central bank, offering a new level of freedom for transactions. The cryptocurrency market, known for its volatility, offers a unique opportunity for investors to maximize their returns. This article aims to explore the best time to buy cryptocurrency and key considerations for investors, providing a comprehensive guide for both newcomers and seasoned investors.

Understanding Cryptocurrency Market Dynamics

The cryptocurrency market is notoriously volatile, with prices fluctuating wildly in short periods. This volatility can be both a blessing and a curse for investors. Several factors influence these price movements, including supply and demand, market sentiment, regulatory news, and technological advancements. Understanding these factors and how they interact is crucial for investors. It’s also important to understand market trends and cycles. For instance, during a bull market, prices are generally on an upward trend, while in a bear market, prices tend to fall. Recognizing these trends can help investors make more informed decisions.

Long-Term Investment Strategy

Investing in cryptocurrencies for the long term has its advantages. Historical data shows that despite short-term volatility, the value of cryptocurrencies like Bitcoin has increased significantly over time. This potential for growth and high returns makes a compelling case for long-term investment. However, it’s essential to understand that past performance is not indicative of future results, and cryptocurrencies remain a high-risk investment. Therefore, a long-term investment strategy should be based on thorough research and a clear understanding of the market.

Short-Term Trading Opportunities

Short-term trading involves buying and selling cryptocurrencies within short time frames to profit from price fluctuations. While this approach can be profitable, it also carries significant risk due to the volatile nature of the market. Before thinking about trading you can try investing in outlets such as SatoshiHero. Technical analysis and indicators can help time trades, and strategies like day trading or swing trading can be used to identify short-term price movements. However, short-term trading requires a significant time investment and a deep understanding of the market.

Market Analysis and Research

Thorough market analysis is crucial for successful cryptocurrency investing. This involves tracking market trends, staying updated with news that could impact prices, and using fundamental and technical analysis to make informed decisions. Fundamental analysis involves evaluating a cryptocurrency’s underlying technology and use case, while technical analysis involves studying price charts and patterns. By combining these two forms of analysis, investors can gain a comprehensive understanding of the market and make more informed investment decisions.

Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a strategy where an investor divides the total amount to be invested across periodic purchases to reduce the impact of volatility. This approach can be particularly advantageous in a volatile market like cryptocurrency, as it allows investors to build a position over time rather than trying to time the market. DCA can help mitigate the risk of making a large investment at an inopportune time.

Market Sentiment and News Events

Market sentiment and major news events can significantly impact cryptocurrency prices. Positive news can drive prices up, while negative news can cause prices to plummet. Monitoring social media and sentiment indicators can provide valuable insights into market trends. It’s also important to stay updated with news from regulatory bodies and major cryptocurrency platforms, as these can have a significant impact on the market.

Economic Factors and Cryptocurrency Performance

Cryptocurrency performance can be influenced by various macroeconomic factors, including interest rates, inflation, and geopolitical events. For instance, during times of economic instability, investors may turn to cryptocurrencies as a “safe haven” asset. Understanding these relationships can help investors make informed decisions. However, it’s important to note that cryptocurrencies can also be affected by factors unique to the digital currency market, such as technological advancements and regulatory changes.

Market Timing Versus Long-Term Investment

Attempting to time the market can potentially yield high returns, but it’s a strategy laden with considerable risk. Conversely, adopting a long-term investment strategy, or spending more ‘time in the market’, can be a safer approach. This strategy allows investors to weather market volatility and benefit from the overall upward trend of the market.

Balancing these two strategies, in accordance with an individual’s risk tolerance and financial objectives, can lead to a more robust investment plan. It’s crucial to bear in mind that despite the allure of market timing, even the most seasoned traders struggle to consistently predict market movements accurately. Therefore, a balanced approach, combining both strategies, can be a more sustainable path to achieving investment goals.

Managing Risk and Diversifying Your Portfolio

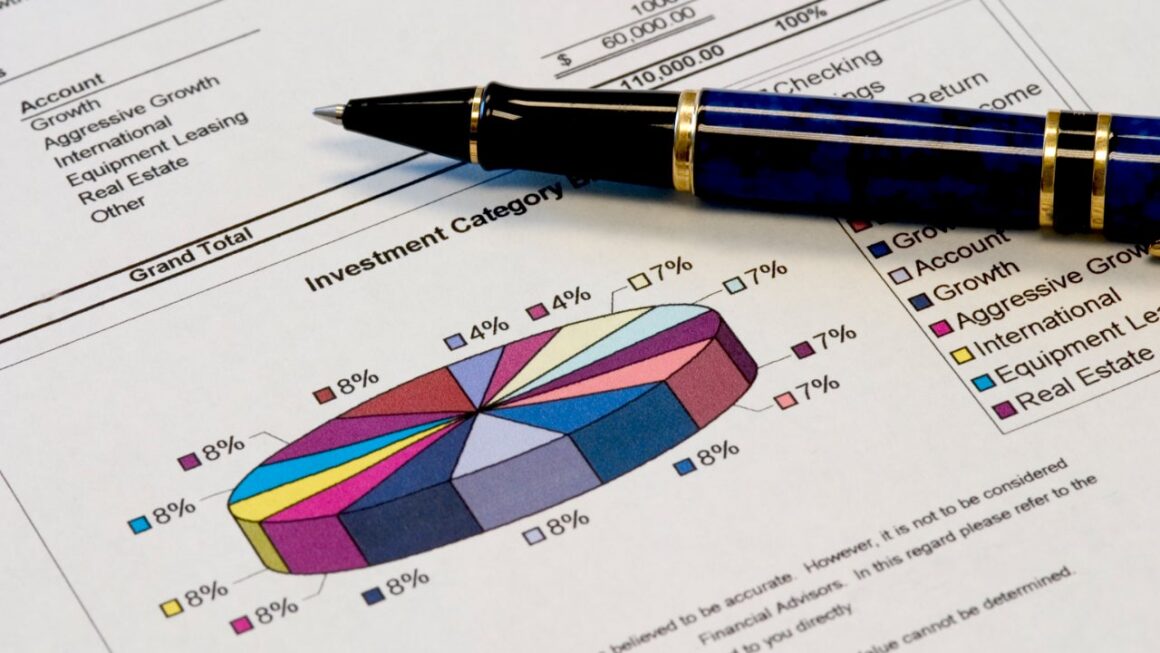

In the realm of cryptocurrency investing, managing risk is of paramount importance. One effective way to manage risk is through portfolio diversification, which involves spreading your investments across various cryptocurrencies and other asset classes.

This strategy can help mitigate the risk associated with the volatility of a single cryptocurrency. Additionally, implementing stop-loss orders can serve as a safety net, helping to limit potential losses should the market take a downturn. It’s also crucial to remember the golden rule of investing: only invest what you can afford to lose.

The value of cryptocurrencies can swing dramatically in both directions, so it’s essential to invest responsibly and avoid risking funds you cannot afford to lose. This approach to risk management and portfolio diversification can provide a more secure foundation for your cryptocurrency investment journey.

Investing in Fundamentals and Promising Projects

Investing in cryptocurrencies with strong fundamentals and promising projects can be a good strategy. This involves evaluating the technology, team, and adoption potential of a cryptocurrency. A project with a strong team, innovative technology, and high adoption potential may offer good long-term growth prospects. However, it’s important to remember that investing in cryptocurrencies is still a high-risk activity, and it’s crucial to do thorough research before investing.

Conclusion

Determining the best time to buy cryptocurrency involves considering various factors, including market trends, economic indicators, and your investment strategy. While long-term investing can offer stability, short-term trading can provide opportunities for significant returns. Ultimately, the dynamic nature of cryptocurrency investing requires a balanced approach and thorough research. Whether you’re a seasoned trader or a newcomer to the world of cryptocurrency, understanding these factors can help you make more informed investment decisions.